SHARES

Share capital

IDGC of Centre charter capital totaled RUB 4,221,794,146.80 as of December 31, 2014, and was divided into 42,217,941,468 common shares with a par value of 10 kopecks The Company did not issue preference shares.

| Securities | Identification number | State registration date of issue | Nominal value, RUB | Number, shares |

|---|---|---|---|---|

| Common registered shares | 1—01—10214-A | March 24, 2005 | 0.1 | 42,217,941,468 |

The authorised stock is 258,532 common registered shares with a par value of 10 kopecks each. The authorised stock was formed during restructuring of the Company in 2008 when it merged the regional grid companies as the difference between the authorised stock and the issued stock.

The Company has no stock in cross holding.

As at the share register closing date for making the list of persons to participate in the annual General Shareholder’s Meeting — May 12, 2014 — the number of persons in the register of shareholders amounted to 16,526.

The total number of persons registered in the Company’s register of shareholders as at December 31, 2014 is 14,191. The state owns a 0.46% share in the charter capital of the Company.

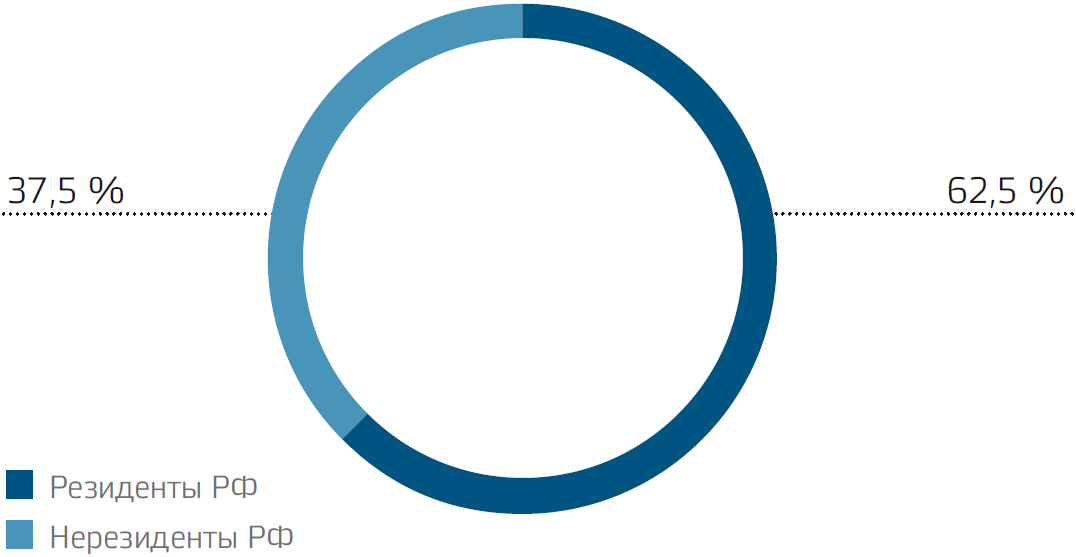

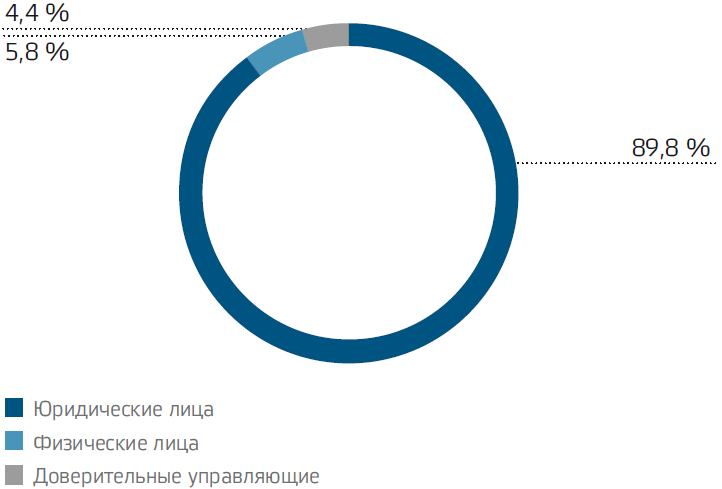

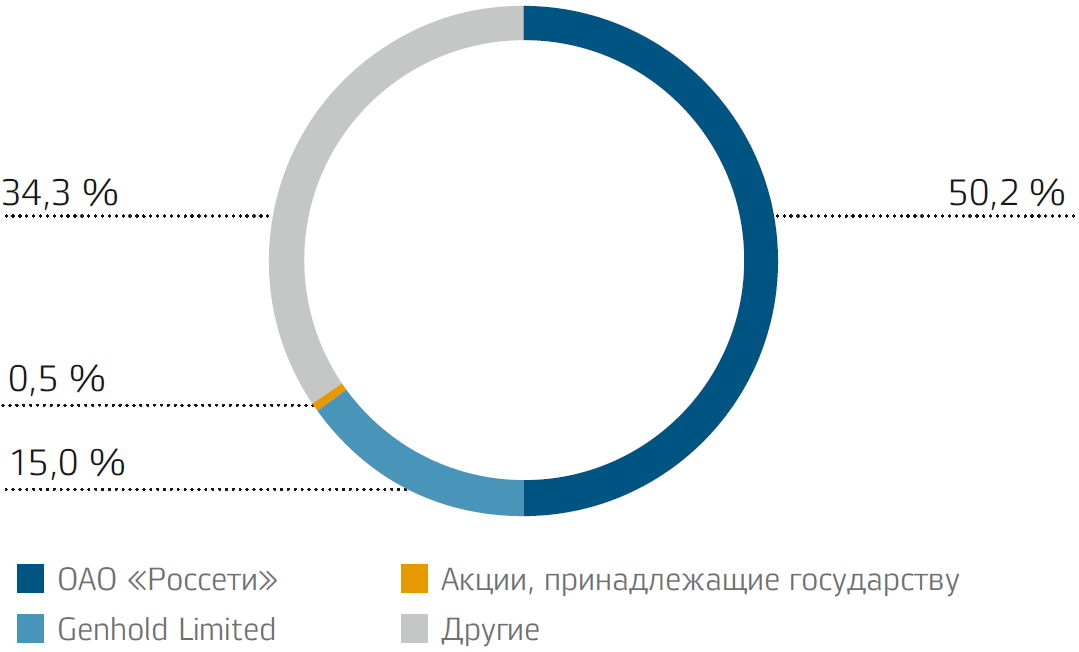

Share capital structure in IDGC of Centre

Major shareholders as at the shareholder close date (May 12, 2014), taking into account nominee holders’ customers

Major nominee shareholders in the shareholders’ register as at December 31, 2014, excluding the details of nominal holders’ customers

| Number of shares | Quantity shareholders | % of the total number of shareholders | % of share capital |

|---|---|---|---|

| 942 | 5.70% | 0.00 | |

| 1,937 | 11.72% | 0.00 | |

| 575 | 3.48% | 0.00 | |

| 3,518 | 21.29% | 0.03 | |

| 5,738 | 34.72% | 0.61 | |

| 3,398 | 20.56% | 2.17 | |

| 324 | 1.96% | 2.08 | |

| 66 | 0.40% | 5.31 | |

| Over 100,000,001 | 28 | 0.17% | 89.80 |

| Total | 16,526 | 100 | 100 |

Share capital structure as at May 12, 2014 (last date of shareholder close date)

Equity holding of affiliated persons in the authorised capital of IDGC of Centre:

- Denis V. Kulikov, Member of the Board of Directors of the Company — owns 0.0007106% (300,000 shares) in the authorised capital of IDGC of Centre.

- Alexander V. Pilyugin, Member of the Management Board of the Company — owns 0.00035% (146,777 shares) in the authorised capital of the Company.

The structure of the share capital as of December 31, 2014 and at the most recent closing date the Company’s share register is the following:

| Structure of share capital as of December 31, 2014 | Structure of share capital as of May 05, 2014 (most recent closing date the share register) | |||

|---|---|---|---|---|

| Shareholder | % of shares issued | Shareholder | % of shares issued | |

| Private shareholders | 3.9 | Private shareholders | 5.8 | |

| Corporate shareholders | 1.1 | Corporate shareholders | 89.8 | |

| Nominee shareholders | 94.8 | Nominee shareholders | 0.0 | |

| Trustees | 0.2 | Trustees | 4.4 | |

| Total: | 100 | Total: | 100 | |

| Russian residents | 99.9 | Russian residents | 62.5 | |

| Foreign residents | 0.1 | Foreign residents | 37.5 | |

| Total: | 100 | Total: | 100 | |

Registrar

The IDGC of Centre share register is kept by an independent registrar, Reestr-RN LLC having a website at: http://www.reestrrn.ru.

Reestr-RN LLC is one of the top ten registrars and consistently takes top positions in the PARTAD national registrars rating.

The registrar’s branches and the Company’s branch divisions fulfilling certain registrar functions operate on the territory of IDGC of Centre activities for the convenience of shareholders and their representatives. Managers on interaction with shareholders at the Company’s branches also provide necessary consultations.

Trading on the stock exchange

Since 2008, Common shares of IDGC of Centre have been traded on the MICEX Stock Exchange, which is a part of the Moscow Stock Exchange group, and as at December 31 2014 are included in the highest ‘A’ listing of the first tier.

The Company’s shares are included in the base for computing the Second Tier Index of the Moscow Stock Exchange (MICEX SC) and the MICEX Power Industry Index (MICEX PWR). In the opinion of the Moscow Exchange Index Committee, the free float ratio is 25%.

| Last traded price, RUB | 0.2525 |

| Last traded price, USD | 0.0045 |

| Shareprice (weighted average), RUB | 0.2735 |

| Shareprice (weighted average), USD | 0.0048 |

| Capitalisation (based on weighted average), mln RUB | 11,547 |

| Capitalisation (based on weighted average), mln USD | 204 |

| Tickers at the main stock exchanges and trading floors |

Moscow Exchange: MRKC Bloomberg: MRKC RX Reuters: MRKC.MM |

| Inclusion to the stock indexes | Moscow Exchange:

|

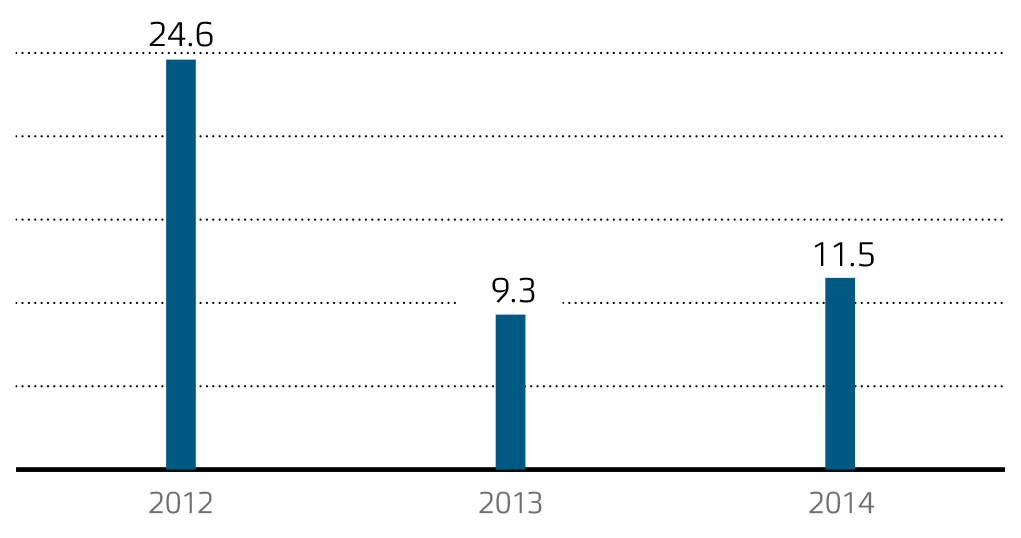

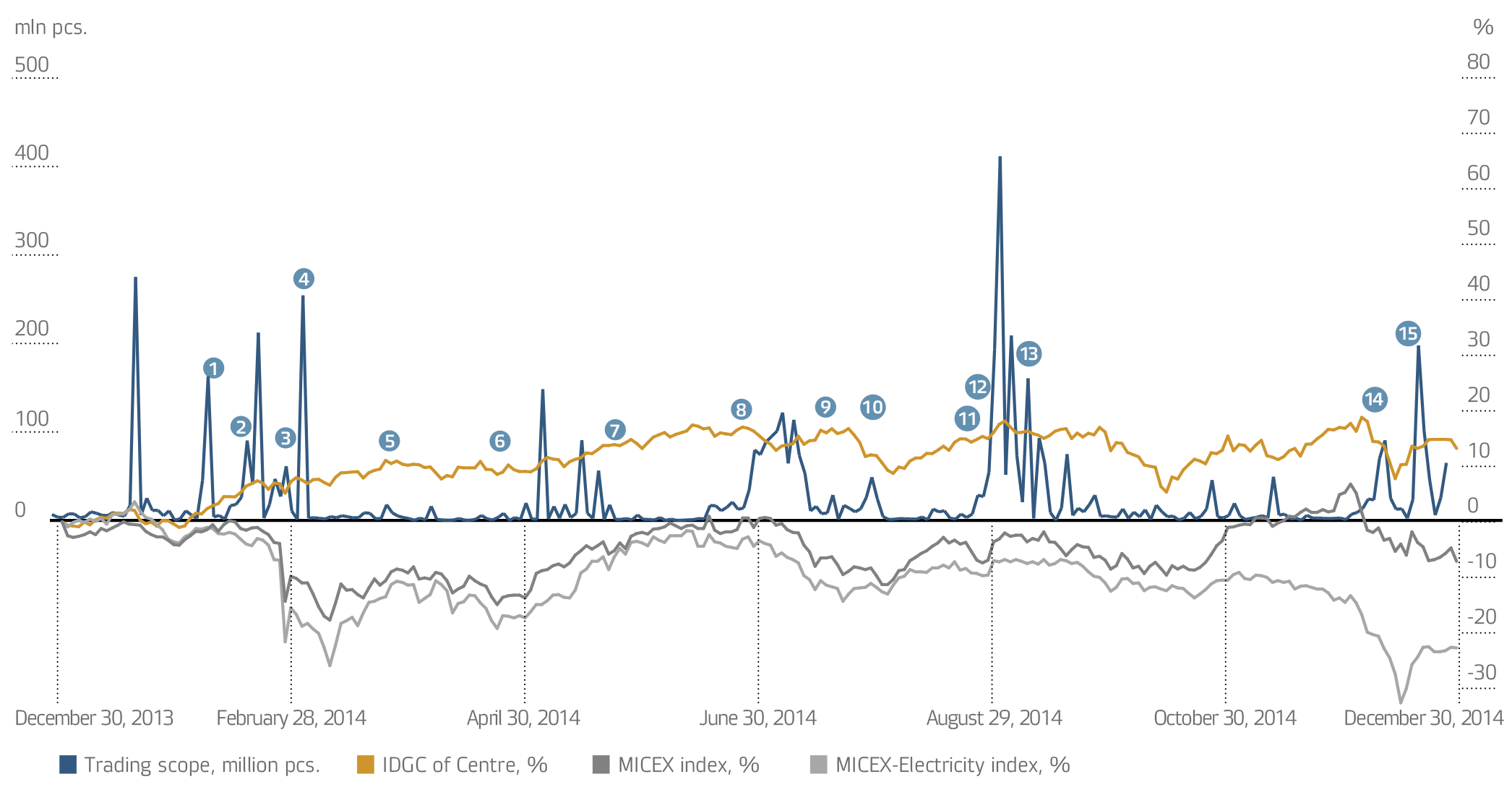

Capitalisation of IDGC of Centre

Capitalisation of IDGC of Centre as at December 31, 2014 totaled RUB 11.5bn and increased by 24.4% vs. 2013.

Key contributions to the capitalisation growth were made due to internal corporate events related to the payment of dividends by 2013 results and the publication of positive statements for the first 6 months of 2014. Additional support to the shares was based on the investment attractiveness of the Company such as development of additional services and presence in the most developed regions of Central Russia. The most active periods of growth were in July and September, the months when the Company reached historical highs in the monthly sales volume of shares.

However, during the year, the adverse events associated with the political situation and the weakening of the national currency had a negative impact on the capitalisation of the Company and the total stock market.

An additional negative factor for the grid sector was caused by the news about the uselessness of privatisation of distribution companies and the lack of legal framework for proper compensation of “income shortfalls” caused by utility connections at a reduced price and by the absence of mechanisms to limit the growth of receivables of SLR suppliers to the grid companies.

The capitalisation dynamics of IDGC of Centre in 2014 was significantly better than the MICEX Index (MICEX) and the MICEX Power Industry Index (MICEX PWR), which ended the year below zero. Dynamics of IDGC of Centre share price compared with MICEX and MICEX PWR indexes in 2013:

| IDGC of Centre, RUB | MICEX Index | MICEX PWR Index | |

|---|---|---|---|

| December 30, 2014 (weighted average) | 0.2735 | 1,396.61 | 797.54 |

| December 30, 2013 (weighted average) | 0.2199 | 1,504.08 | 1,032.39 |

| Change, % | 24.4 | —7.1 | —22.7 |

| MAX (at closing) | 04.09.2014: 0.358 | 03.12.2014: 1,606.84 | 23.01.2014: 1,069.06 |

| MIN (at closing) | 25.04.2014: 0.186 | 14.03.2014: 1,237.43 | 16.12.2014: 938.03 |

| Indicators | 2012 | 2013 | 2014 | Deviation 2014/2013, % |

|---|---|---|---|---|

| Number of transactions | 37,874 | 33,310 | 43,900 | 31.8 |

| Volume, mln | 1,979.4 | 2,146.1 | 6,007.9 | 179.9 |

| Volume, mln RUB | 1,228.2 | 786.6 | 1,594.8 | 102.7 |

| Volume, % of Free float | 18.7 | 20.3 | 56.9 | 36.6 p.p. |

| Indicators under RAS | Unit | 2012 | 2013 | 2014 |

|---|---|---|---|---|

| Closing price at year end | RUB | 0.6 | 0.2186 | 0.2525 |

| High for the year | RUB | 0.8756 | 0.6954 | 0.3705 |

| Low for the year | RUB | 0.3867 | 0.1803 | 0.183 |

| Average daily trading volumeAverage on the Moscow Exchange. | RUB mln | 4.82 | 3.15 | 6.38 |

| shares mln | 7.76 | 8.58 | 24.03 | |

| Earning per share (EPS) | RUB | 0.08 | 0.01 | 0.08 |

| Dividend yield (year-end) | % | 4.07 | 0.82 | 7.80 |

| EV/EBITDAFormula: Dividends/Number of shares/Year-end closing price The figure for 2014 is stated as per the forecast. The amount of dividends for 2014 will be decided at the Annual General Shareholders’ Meeting in June 2014. | — | 4.08 | 3.59 | 3.09 |

| P/E | — | 7.14 | 31.70 | 3.47 |

| TSR | % | —1.72 | —60.63 | 26.57 |

THE FORMULA FOR CALCULATING TSR:

TSR=((Ак — Ан + DA) / Ан) • 100 %,

where

TSR — Total shareholder return

Ак — Share price at end of period

Ан — Share price at the beginning of the period

DA — Dividends accrued per share in the reporting period, approved by the AGM decision

| No. | Event | Date | Factor | Impact |

|---|---|---|---|---|

| 1 | February 13 | Approval by regional energy commissions of electricity transmission tariffs in all regions where IDGC of Centre operates |

|

|

| 2 | February 17 | Message of Alexey Teksler, Minister of Energy to inform that the Russian Ministry of Energy does not the reject IDGC privatisation plans |

|

|

| 3 | February 28 | Stock market crash due to Crimean events |

|

|

| 4 | March 04 | Publication of the 2013 RAS financial statements by IDGC of Centre |

|

|

| 5 | March 26 | Interfax informs that the Russian Ministry of Energy finds privatisation of one IDGC highly unlikely in 2014 |

|

|

| 6 | April 22 | Kommersant publication on a shortage in income of Russian Grids estimated by the company at RUB 140 billion by 2018 due to grid connection of consumers entitled to special benefits |

|

|

| 7 | May 21 | JSC ROSSETI signs a strategic cooperation agreement with the State Grid Corporation of China and agrees on joint research of the possibilities of building an UHV ETP to supply electricity from Russian to China |

|

|

| 8 | June 26 | Message from Kommersant newspaper: The Russian Ministry of Energy considers the option of extending the “last line” (see page 137 of the Annual Report) in several regions |

|

|

| 9 | July 18 | According to bfm.ru, Russian Grid petitioned the Government to accelerate tariff indexation in 2015 |

|

|

| 10 | July 31 | IDGC of Centre published the financial statements for the first six months of 2014 (RAS). The Company’s net profit demonstrated a 66.7% growth |

|

|

| 11 | August 20 | Renaissance Capital renewed analytical services to grid companies. The securities only of two out of 14 companies (IDGC of Centre and IDGC of Centre and Volga Region) were recommended for purchase |

|

|

| 12 | August 28 | According to Vedomosti, the Russian Ministry of Energy proposed to the Ministry of Economic Development to index the tariff for Russian Grids in 2015 4 p.p. above the inflation level |

|

|

| 13 | September 10 | Russian Grids submitted the draft long-term development strategy that included exchange of shares of subsidiaries |

|

|

| 14 | December 11 | Approval by IDGC of Centre Board of Directors of the 2015 Business Plan |

|

|

| 15 | December 16 | Stock market crash due to a weakening ruble |

|

|

|

internal factor |

|

external factor |

|

positive impact |

|

negative impact |